Spotify's public filing reveals key stats about the streaming giant

It's hard to make money streaming music.

Spotify quietly signaled its intention to become a publicly traded company in December of last year, even though several lawsuits over licensing were looming. Now the streaming service has filed for a direct listing on the New York Stock Exchange, an alternative to the more typical initial public offering (IPO) that offers the company a savings on underwriting fees and a dilution of existing shares.

The prospectus document provides quite a bit of information on the company's financials, which helps investors make a more informed decision when purchasing stock. The data speaks to how hard it is to make money as a streaming services provider. For example, the company's losses are increasing rapidly. In 2015, 2016, and 2017, the company incurred net losses of €230 million, €539 million, and €1,235 million, respectively. That's despite revenues of €1,940 million, €2,952 million, and €4,090 million in the same years. Plus, their closest competitor, Apple Music, claims a 45 million song base, while Spotify has 35 million.

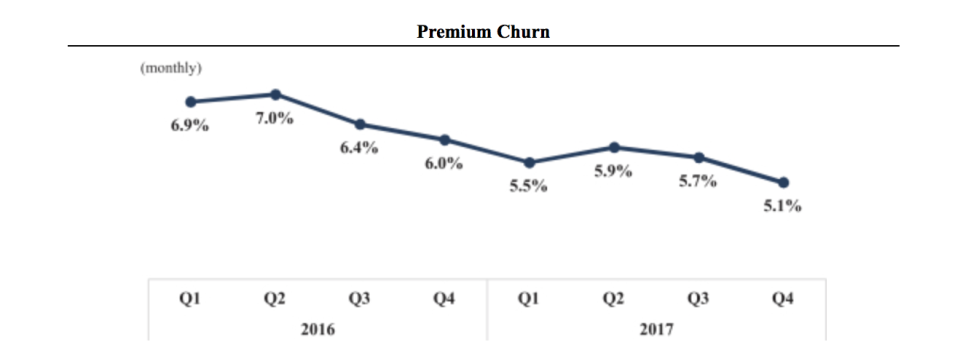

Things aren't all bad, however, as the company says that its paid subscriptions are growing much faster than its ad-supported ones. The 71 million paid subscriptions have increased at a rate of 46 percent year over year as opposed to 19 percent year over year growth for free accounts. The company has 159 million monthly active users, too, with each of them averaging 25 hours of listening time per month. In addition, the premium churn - a measure of how many subscribers quit the service, continues to decrease. That points to better customer satisfaction over time.

Finally, only 13 percent of the payment-enabled smartphone users in Spotify's 61 countries and territories use the platform as of the end of last year. That means the company has a ton of potential subscribers who they can entice to the platform. Of course, this is all just basic facts. We'll see if the streaming giant can figure out how to turn this all into a profitable company in the months to come